Through a Glass, Darkly: How Lebanon’s Central Bank Wants You to See the Financial Collapse

On July 8, 2021, the Lebanese Central Bank (BDL) gave us a peek into how it would like to officially depict the financial collapse, through the publication of its 2020 Annual Report in the National Gazette.

The Public Source dove into what the BDL’s 2020 Annual Report shows and doesn’t show — so that you don’t have to.

On general macroeconomic indicators, the BDL’s report paints a grim picture — though less grim than the reality and nothing we did not already know from other sources. If we dig deeper, particularly into its description of BDL’s monetary policies, we find three critical questions: Where is the gold? How exactly are foreign currency reserves being spent on subsidies? And what’s the deal with the Eurobonds?

BDL’s Bird’s-Eye View: Grim but Brighter Than Reality

Lebanon’s macroeconomic indicators for 2020 were not good, and the BDL’s report does not sugar coat it.

Lebanon’s gross domestic product (GDP), in decline since 2018, dropped by $18 billion (35 percent) between 2019 and 2020 (Figure 1).

Fig. 1: Lebanon’s GDP (in billions of US dollars) from 2017 to 2020. Sources: BDL’s annual reports for the years 2017-2020, retrieved from the National Gazette; World Bank Open Data portal.

Yet GDP has long been criticized for being an imperfect, if not heavily flawed, indicator. It aggregates a country’s total economic output by calculating the value of goods and services produced in it; having nothing to say about the overall well-being of the population, the standards of living, or average income.

We turn to other indicators for a more complete view of Lebanon’s economic collapse.

The BDL report contains figures on inflation that depict the skyrocketing cost of goods and services. From 2017 to 2019, annual inflation hovered between 2.9 and 4.5 percent, but it jumped to 84.9 percent in 2020 (Figure 2).

Fig.2: Lebanon’s annual inflation rate (in percentages) from 2017 to 2020. Sources: BDL’s annual reports for the years 2017-2020, retrieved from the National Gazette.

While 84.9 percent inflation seems gargantuan, it actually masks the gravity of the situation. The BDL’s figure is the product of some statistical magic. Although the report fails to mention either the sources or the methodology used to calculate inflation, it would seem that the measure is lumping the prices of all goods and services.

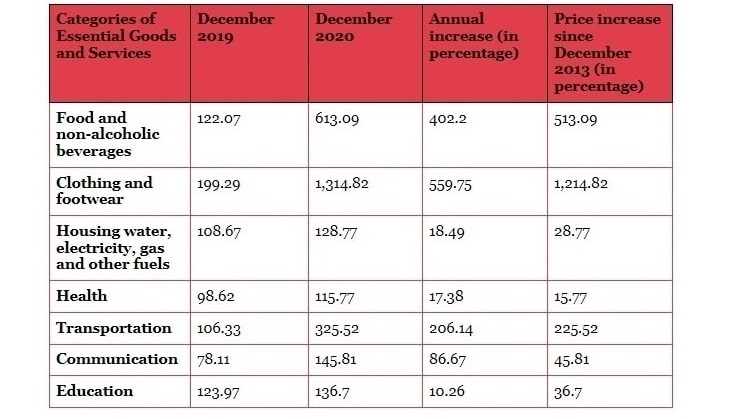

We arrive at a more accurate inflation rate by using the Consumer Price Index (CPI), which measures the changes in prices of a wide array of goods and is calculated on a monthly basis by the government’s Central Administration of Statistics (CAS). The CAS takes December 2013 as the benchmark timeframe and sets the price of food and non-alcoholic beverages that month at 100. As an example, the fact that in December 2014 the CPI stood at 101.29 means that between December 2013 and December 2014, the price of food and non-alcoholic beverages increased by 1.29 percent.

As the CAS’s CPI figures show (Table 1), between December 2019 and December 2020, the price of food and non-alcoholic beverages increased by 402.2 percent, the price of clothing and footwear shot up by 559.75 percent, while transportation costs rose by 206.14 percent.

The BDL’s 84.9 percent figure pales in comparison.

Table 1. Lebanon’s Consumer Price Index on several essential goods and services in December 2019 and December 2020. Source: Central Administration of Statistics’ CPI reports.

The BDL report also contains figures related to Lebanon’s balance of trade, which is the difference between the total value of a country's exports and imports.

Lebanon’s imports have long exceeded exports — a result of a deliberate policy by the ruling class to prioritize the finance, real estate, and service sectors at the expense of productive sectors of the economy. Lebanon imports around 85 percent of its food needs and over 90 percent of pharmaceutical products sold locally.

While 84.9 percent inflation seems gargantuan, it actually masks the gravity of the situation. The BDL’s figure is the product of some statistical magic.When a country imports more goods and services than it exports, it has a trade deficit.

The BDL report notes that Lebanon’s trade deficit actually halved in 2020, from $15.5 billion to $7.8 billion — a trend that tracked the significant reduction in imports: from $19.6 billion in 2019 to $11.35 billion in 2020 (Figure 3).

The drop in imports has been attributed to the national foreign currency shortage. Large trade deficits leave a country vulnerable to economic downturns; currency devaluations make imports very expensive.

Lebanon’s chronic trade deficit has historically been partly offset in two ways: loans taken by the government, and remittances from the diaspora.

Regarding the former, the public debt continues to grow. In 2020, it stood at L.L. 144,117 billion (equivalent to $95.6 billion at the official rate, which the BDL report still uses), whereas in 2017, it stood at L.L. 104,239 billion (Figure 4). For the sake of comparison, the public debt stood at L.L. 4,974 billion (roughly $3.2 billion) in December 1993 — shortly after the end of civil war, when Lebanon was on the verge of a much-vaunted reconstruction bonanza.

Fig.4: Lebanon’s Public Debt (in billions of dollars) from 2017 to 2020. Sources: BDL’s annual reports for the years 2017-2020, retrieved from the National Gazette.

As for diaspora remittances, the BDL report also brings bad news. In 2020, Lebanese expatriates sent a total of $6.3 billion, whereas in 2018 and 2019, they had sent $7 billion and $7.41 billion respectively.

Beyond the macroeconomic data, three main problems appear when digging deeper into the BDL’s annual report.

The first problem deals with the most devilish mineral of all, gold.

Where Is the Gold?

In 1986, parliament passed Law no. 42 banning the use of BDL’s gold reserves under any circumstances, barring parliament passing a law to expressly authorize it — which it never passed.

Protecting the BDL’s gold is the stuff of lore. Former BDL governor Edmond Naim (who served between 1985-1991) is reported to have moved into BDL in 1987, in order to physically and symbolically protect the gold reserves from being snatched by warring militias.

But how much gold does BDL have today?

In December 2020, one of the BDL vice-governors informed parliament that the last time the central bank’s gold reserves were counted was in 1996, and that based on his estimates, 60 percent of these reserves remained in Lebanon while the rest were in the United States. The World Gold Council, a global lobbying group composed of the world’s major gold mining companies, estimates that in 2020, the BDL’s gold reserves were worth $17.4 billion.

In its 2020 annual report, the BDL does not specify the total amount of gold it holds. Instead, it states that its total external reserves, which include gold, stood at $9.41 billion. Interestingly, on July 22, the National Gazette published a correction attributed to a typographical error: the BDL does not have $9.41 billion in total external reserves — it has $41.9 billion.

How much gold is actually held is an extremely important question in the context of economic and financial collapse. Reserves could theoretically be used to usher in an economic recovery if used to support productive sectors of the economy, to ensure basic social protections and social services to the population, and to upgrade Lebanon’s dilapidated infrastructure.

Recently, Mouwatinoun wa Mouwatinat fi Dawla (“Citizens in a State,” abbreviated MMFD), one of the new anti-establishment political parties, launched a campaign cleverly titled “mustaqbalak dhahab,” which can simultaneously mean “your future is gold” or “your future is gone.” The campaign sought to raise awareness about what could be productively done with the gold reserves, but also to warn citizens that the gold could very well end up being used by the political class to continue the subsidization policy that started in 2020 and simply buy more time for the unsustainable status quo. As some members of the ruling class openly call for selling off Lebanon’s gold reserves, knowing how much gold Lebanon actually has and how these reserves are to be used is of the utmost importance.

But what exactly are the subsidies? And where do they prefigure in the BDL annual report?

Mouwatinoun wa Mouwatinat fi Dawla, one of the new anti-establishment political parties, launched a campaign cleverly titled "mustaqbalak dhahab," which can simultaneously mean "your future is gold’" or "your future is gone."

Why Don’t We Know More About the Subsidies?

In May 2020, the Ministry of Economy and Trade issued a policy to subsidize a wide range of imported goods it deemed essential. The policy would allow local companies to import select goods at the official rate of L.L. 1,507.5, or at the L.L. 3,900 rate to the dollar. At a time when the Lebanese Lira was devaluating, BDL would use its foreign currency reserves to cover the difference.

The annual report notes that BDL used $5 billion to subsidize the import of basic commodities: medicines, fuel, and wheat. Yet, the BDL depleted more than double that amount from its foreign currency reserves in 2020 (Figure 5). The annual report is vague on how the additional $7.8 billion were depleted, and completely silent on money transfers abroad by big depositors.

Fig.5: BDL’s Foreign Currency Reserves (in billions of dollars) in 2019 and 2020. Source: BDL’s 2020 Annual Report, retrieved from the National Gazette.

The report also excludes a breakdown of the spending on subsidies, so we cannot know how much was spent on which type of commodity — critical information given that not everyone benefits equally from subsidies. While everyone does gain from subsidized goods, public welfare was not really the motivation for Lebanese policymakers. Instead, the subsidization policy was meant to placate politically affiliated cartels that dominate Lebanon’s economic sectors, create monopolies, and keep prices artificially high for consumers in order to make hefty profits. The policy of subsidizing the import of fuel, wheat, and medicines was designed and implemented with the interests of the politically affiliated cartels in mind.

As BDL began to lift subsidies in mid-2021 — such as on fuel imports, leading to skyrocketing gasoline prices and endless queues in front of petrol stations — knowing how foreign currency reserves were spent and who ultimately benefited the most from them is crucial. The BDL annual report has no answers.

What Was the Deal With the Eurobonds?

The third problem takes us to the infamous default on the Eurobonds in March 2020, when the Lebanese government did not pay $1.2 billion due to external creditors as part of this foreign currency debt instrument.

The Association of Banks in Lebanon (ABL) had called on the government to pay the Eurobonds “in order to protect depositors’ interests, to maintain Lebanon’s position in international financial markets and to safeguard its relations with correspondent banks and external creditors.”

The BDL 2020 report echoes the ABL’s arguments, alleging that the default resulted in a loss of international trust, which in turn froze any international aid plans (such as the loans pledged during the 2018 CEDRE conference); and that it decreased remittances and expatriate investments, especially in real estate.

This is simply not true.

The “loss of confidence” by international and local actors preceded the Eurobond default, dating to the ABL’s devious schemes against depositors, which included enacting informal capital controls beginning in September 2019 on small depositors, all the while allowing big depositors to transfer large sums abroad.

It also dates to the BDL’s demonstrated lack of transparency and accountability.

In July 2020, the government contracted Alvarez & Marsal, a consultancy firm specialized in corporate restructuring, to carry out a forensic audit of BDL’s accounts, one of the key conditions imposed by the International Monetary Fund before any ‘financial rescue’ plan. However, BDL governor Riad Salameh infamously produced very few of the documents that the auditors requested. According to Forbes Middle East, under the guise of Lebanon’s banking secrecy law, BDL refused to provide answers to over 100 questions asked by the auditors. In November 2020, facing BDL intransigence, Alvarez & Marsal withdrew from the forensic audit.

The “loss of confidence” by international and local actors preceded the Eurobond default, dating to the ABL’s devious schemes against depositors, which included enacting informal capital controls beginning in September 2019, all the while allowing big depositors to transfer large sums abroad.

Faced with this embarrassing turn of events, parliament passed Law no. 200 in December 2020, which allows for lifting banking secrecy from the BDL accounts of government entities in order to complete the forensic audit. The law was deliberately designed to be in effect for only one year, and it was unclear whether the contracted firm would resume its work. The new Najib Mikati-headed government then signed a new contract with the firm in mid-September 2021 to carry out yet another forensic audit and present an initial report within 12 weeks.

It is unclear whether the firm will face the same intransigence from the BDL governor. But it is doubtful that a government headed by a billionaire facing credible allegations of grand corruption would be inclined to lift banking secrecy or press the BDL governor to provide the firm with the documents needed.

A photoshopped image of the wall adjacent to BDL on Hamra Street that made the rounds on social media in late 2019. A fresh coat of paint covered anti-BDL graffiti. The photoshopped text reads, "First of all, good evening; second, congratulations on the new paint job.'" (Source unknown)

A Crapshoot Conclusion

BDL’s Annual Report 2020 carries some useful macroeconomic indicators, but none that we hadn’t already seen in mainstream studies, such as the World Bank’s ‘The Deliberate Depression” report that a group of Lebanese economists published in December 2020.

Beyond the macro-level, piecemeal view, the report leaves fundamental questions unanswered and reveals a practice of hiding crucial information from the public. Ultimately, it reminds us that for the political and economic elite — the BDL, the ABL, Lebanon’s “incompetent and shortsighted” banking sector, the political class, and the cartels — it is business as usual, come hell or high water.