The Full Story Behind the Looming Collapse of the National Social Security Fund

Editor's Note: The black dots (●) in the text are clickable to display documents that we retrieved through Access to Information requests.

“I’m fed up! I’m never going to the Daman office again!”

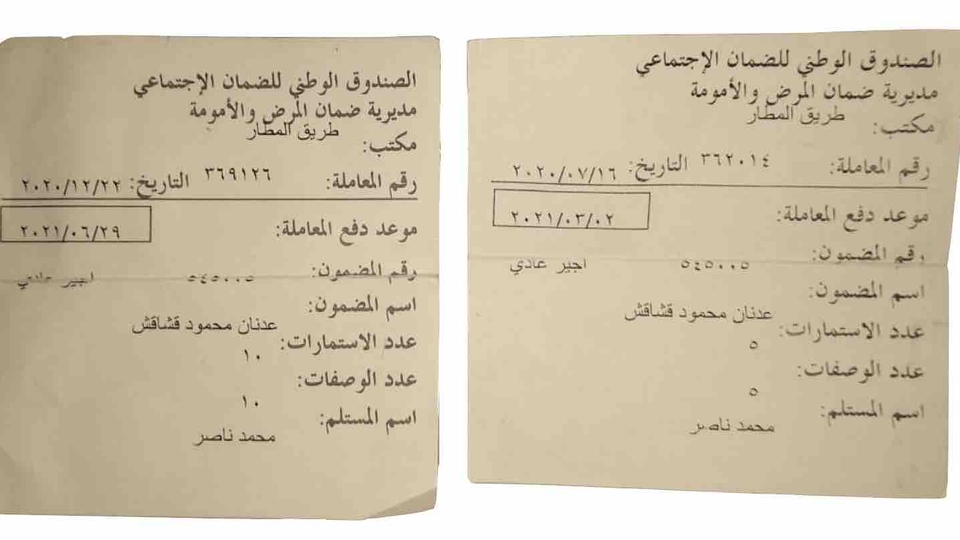

Adnan Kashakish has been waiting for his reimbursement from Lebanon’s National Social Security Fund (NSSF) since March 2021, when he was supposed to be paid back for receipts he submitted in July 2020.

“I applied to be reimbursed for my medicines. They are not cheap medicines,” Kashakish, or Abu Atef, as he is better known, told The Public Source.

The NSSF owes Abu Atef over L.L. 1 million — an exorbitant amount for him despite the currency collapse. Like most workers in Lebanon, he still earns his wages in local currency.

As a 60-year-old employee in a small business that sells electric appliances, Abu Atef has been paying his monthly dues to the NSSF since 1996. He is one of 1.4 million people in Lebanon — workers and their dependents — entitled to receive coverage from the NSSF, according to official figures from 2014, the latest available.

The NSSF, Lebanon’s largest employment-based provider of social services, has provided woefully insufficient coverage since it was established in 1965. It excludes those in informal labor and the unemployed; as soon as an NSSF enrollee loses their job, they are no longer entitled to health coverage (unless they opt into a separate pay scheme). It doesn’t provide insurance against workplace accidents or occupational hazards, although it was supposed to in its establishment law. Foreign workers are not entitled to any coverage, yet their employers must still account for them in their mandatory contributions to the NSSF. And Lebanon is the only country in the MENA without an official pension scheme for workers in the private sector.

Yet despite its significant shortfalls, the NSSF still offered a modicum of social protection to a substantial part of the population. An estimated 840,000 individuals benefited from the NSSF’s services in 2017.

The NSSF is supposed to cover the bulk of the healthcare costs of subscribers and their dependents. This includes all medical examinations, in-patient and out-patient services, as well as 80 percent of the cost of medicines — 95 percent if these drugs are for chronic and costly diseases, like cancer.

Despite its significant shortfalls, the NSSF still offered a modicum of social protection to a substantial part of the population. An estimated 840,000 individuals benefited from the NSSF’s services in 2017.

The NSSF also gives subscribers a modest cash allowance for their children (L.L. 33,000 per child, with a maximum of five children) and L.L. 60,000 for their spouse. When the Lebanese Lira was still pegged to the US dollar, it amounted to $22 per child, and $40 for their spouse. By February 2022, with the exchange rate close to L.L. 21,000 to the dollar, the allowance is equivalent to a measly $1.5 and $2.8, respectively.

Today, long queues have become the norm in NSSF offices, as subscribers wait hours to get the compensation they are owed, only to leave empty-handed, like Abu Atef.

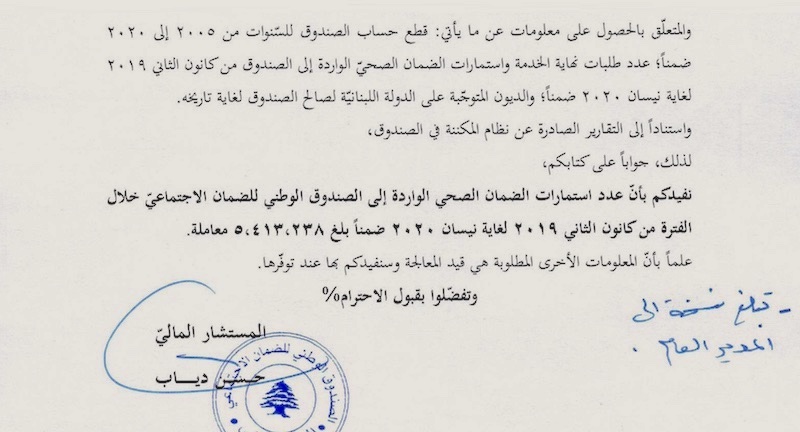

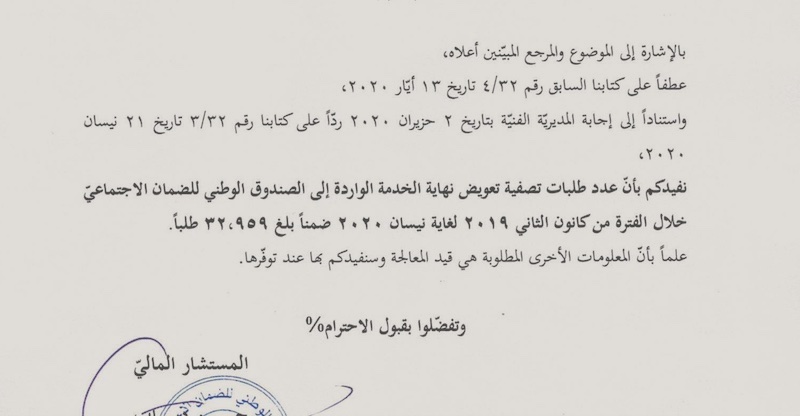

In response to an information request from The Public Source, the NSSF revealed that over 5.4 million requests for health insurance and 32,959 requests for the end-of-service indemnities were under review between January 2019 and April 2020. [note:1]

But it is unclear how many people are in Abu Atef’s situation and when exactly the NSSF stopped paying up. Reports about the NSSF withholding compensation began circulating in early 2020.

What is increasingly clear is that the NSSF cannot pay up.

“There is a real danger today that all of the people who pay their dues in the NSSF will not be able to get their end-of-service indemnities because there is no cash. [The NSSF] needs to get the cash from the Ministry of Finance — we all know the Ministry of Finance’s situation today. Where will it get the cash?” asked Akram Najjar, a former member of the NSSF Board of Directors, during an interview with The Public Source.

Assuming that the NSSF will never pay, hospitals are refusing to treat NSSF subscribers, unless they are willing to pay out of pocket at market rates.

The Public Source analyzed NSSF budgets from 2005 to 2018 — obtained through an information request as per the Access to Information Law — to track the catastrophic financial decisions that led us here.

We interviewed NSSF subscribers, former and current staffers and advisers, as well as critics who have been trying to sound the alarm bells. The message is loud and clear: The NSSF is on the brink of collapse.

This is the story of how millions of people lost a key lifeline amid economic free fall and who is ultimately responsible. [note:2]

Subscribers wait in long lines to receive compensation for their healthcare costs at the NSSF’s branch in Cola. Beirut, Lebanon. October 8, 2021. (Marwan Tahtah/The Public Source)

Adnan ‘Abu Atef’ Kashakish’s NSSF receipts indicate he was due to be reimbursed on March 2, 2021 and June 29, 2021. As of the time of writing, he has not been reimbursed. (Photo courtesy of Adnan Kashakish)

The NSSF’s Long-Time Money Problems

The NSSF has struggled financially for over two decades.

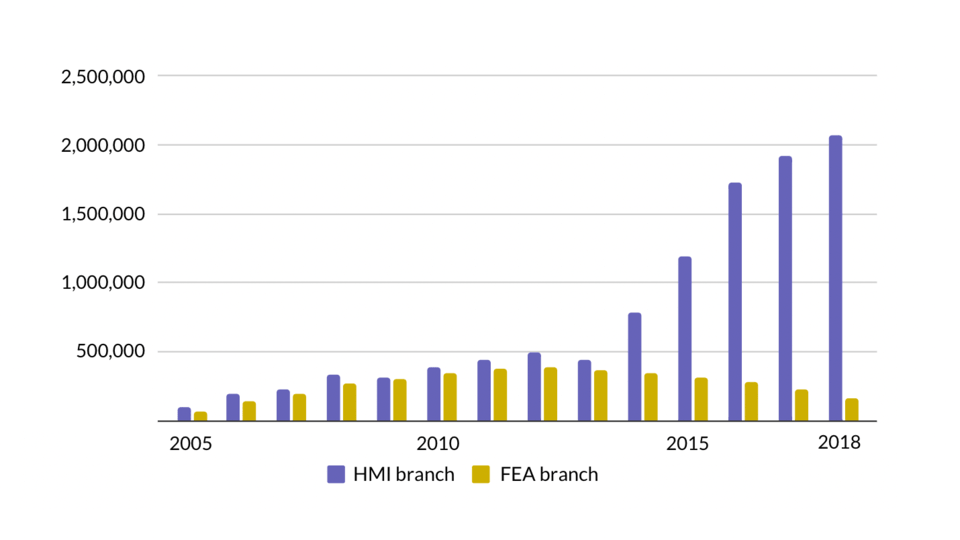

The NSSF is composed of three branches: the Health and Maternity Insurance (HMI), the Family and Education Allowances (FEA), and the End of Service Indemnity (ESI). Two of these three operational funds – the HMI and the FEA – have been running a deficit since April 2001. While the FEA branch operated with a surplus in recent years, it was not enough to cover the debt it accrued.

Behind these deficits are deliberate neoliberal policies that have gutted what little social protections the Lebanese state afforded.

Between 1993 and 2001, under former Prime Minister Rafic Hariri, a series of governmental decrees slashed the rates employers are mandated to pay to the NSSF to cover their workers, in the spirit of reducing “the cost of doing business in Lebanon.”

Before 2001, employers paid around 38.5 percent of their employees’ monthly salaries as contributions to the NSSF. Today, employers pay only 22.5 percent. Labor representatives at the fund repeatedly rejected reducing employer contributions, fearing it would run down NSSF reserves.

And as inflows were reduced, the cost of healthcare was shooting up — also due to political choices.

Take the case of drugs to treat cancer, whose incidence in Lebanon is among the highest in the region. Were these drugs to be purchased directly from international distributors, cutting out the middlemen, the NSSF would save $100 million annually, according to NSSF board member Adel Olleik. Plans for the NSSF to import medicines directly into Lebanon have repeatedly been blocked by Lebanese pharmaceutical importers.

Another large part of the deficit is explained by the fact that the Lebanese government owes very large sums to the NSSF. By law, the government is mandated to cover 25 percent of the HMI branch’s expenses, but successive governments have withheld these transfers.

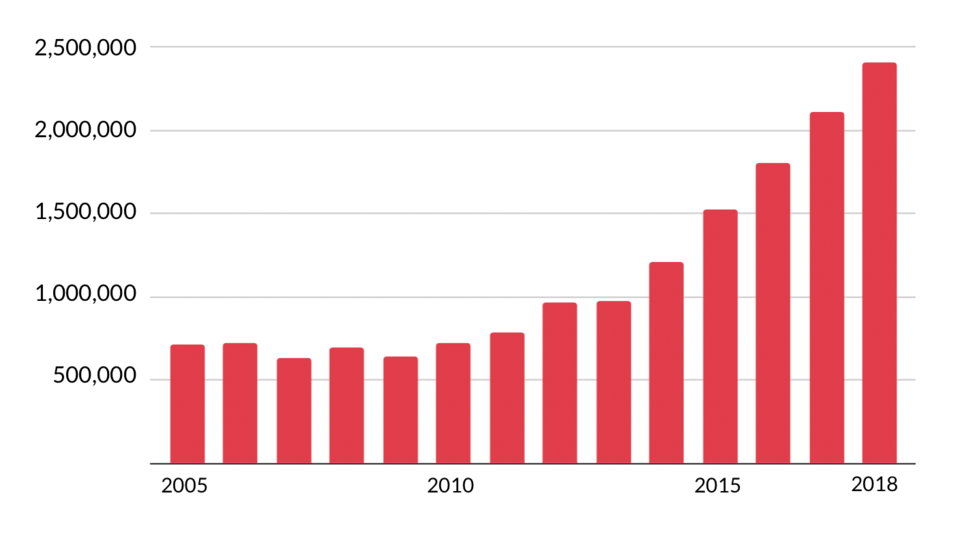

From 2005 until 2013, the Lebanese state owed the NSSF between L.L. 71.6 billion to L.L. 96.6 billion — roughly between $470 million and $639 million at the official exchange rate. But the debt skyrocketed after 2013, eventually reaching L.L. 2.4 trillion in 2018 — over $1.6 billion on the official rate.

From 2005 until 2013, the Lebanese state owed the NSSF between L.L. 71.6 billion to L.L. 96.6 billion — roughly between $470 million and $639 million at the official exchange rate. But the debt skyrocketed after 2013, eventually reaching L.L. 2.4 trillion in 2018 — over $1.6 billion on the official rate.

Yet, as published in the Ministry of Finance’s monthly Public Finance Monitor bulletins, the state only allocated L.L. 70 billion (around $46.6 million at the official rate) to the NSSF in 2016, nothing for the next three years, and L.L. 100 billion in 2020 (around $66.6 million at the official rate, but far lower by then as the Lira had begun to devalue) — breadcrumbs compared to what it owes.

“The state, as per the NSSF law, is breaking the law,” summed up Adib Bou Habib, secretary-general of the Printing Press Employees Trade Union and head of the Lebanese Trade Union Training Center.

Figure 1: Amount owed by the Lebanese state to the NSSF (in millions of Lebanese Liras). Source: NSSF Budgets 2005-2018.

The state debt to the NSSF was no secret, even before the economic collapse. The director general of the NSSF, Mohamad Karaki, periodically made statements to the press calling on the government to pay its debts. And in 2018, Olleik, an NSSF board member, told the press he estimated state arrears to the NSSF to be around $1.5 billion.

How did the NSSF manage to keep going?

The answer brings us to the only branch in the NSSF that continuously generated a surplus, the End-of-service Indemnity branch, whose surplus was used to cover the deficits of the other two branches — despite the fact that doing so violates NSSF law, which mandates that the branches be financially autonomous from one another.

And the reason the end-of-services fund has run a surplus is that it provides very limited coverage.

In fact, this fund was supposed to be temporary — only “until a retirement pension plan is enacted,” according to the NSSF law. That day never came, leaving Lebanon with very limited retirement protections.

Upon reaching retirement age, workers who contribute to the NSSF throughout their life simply receive a small lump sum payment, rather than a monthly pension. After 45 years of employment, indemnities would barely cover three years.

Retirees also lose their NSSF-provided health insurance. Unsurprisingly, many elderly in Lebanon have long relied on remittances from their adult children abroad or on charities, with the situation becoming more dire.

Funds from the flawed End-of-service Indemnities branch are regularly used to cover the deficits of the HMI and FEA branches. This was particularly acute in the case of the HMI branch, whose deficit has grown at an alarmingly high rate in recent years, reaching L.L. 2.068 trillion in 2018 — or $1.378 billion at the official rate.

That is how the NSSF hobbled along until the crisis hit.

Figure 2: Amount of funds transferred to the HMI and FEA branches from the NSSF’s reserves, including the End-of-service Indemnity branch (in millions of Lebanese Liras). Source: NSSF Budgets 2005-2018.

Wrapped up in the Ponzi Scheme: The NSSF’s Liquidity Crisis

In December 2020, the NSSF’s chief financial officer (CFO) Chawki Abou Nassif told The Public Source that the Lebanese state owed the NSSF around L.L. 4 trillion — a marked increase from the L.L. 2.4 trillion (or $1.6 billion at the official rate) it owed in 2018 (the most recent budget The Public Source had access to).

Abou Nassif also said the NSSF has been “in a state of emergency since [2019],” but “as long as medicines are still subsidized by the central bank, the danger is still a bit far.”

Today, in early 2022, most subsidies on medicines have been lifted as the central bank’s foreign currency reserves dried up.

Moreover, the NSSF has been struggling to make the payments due to hospitals.

“The NSSF has a lot of arrears to hospitals, there is not enough liquidity, particularly with the economic crisis and the rising costs of hospital bills,” said Mahmoud Choucair, president of the High Medical Advisory Committee of the NSSF and a professor at the American University of Beirut Medical Center (disclosure: related to the editor of this piece). Interviewed in September 2021, not long after the central bank lifted most subsidies, he added, “the NSSF is agreeing with hospitals to extend an advance; so let’s say the NSSF owes AUBMC L.L. 1 billion, rather than paying the whole sum, the NSSF pays an advance of L.L. 200 million, for example.”

A liquidity problem is particularly dangerous for the NSSF during economic collapse, when subscribed workers are being laid off — therefore halting their contributions to the NSSF — while employers either struggle to make their payments or find workarounds.

“Business owners are avoiding paying NSSF subscriptions! Many don’t reveal the real salaries of their workers — for example, let’s say an employee earns L.L. 2 million, but the employer registers the salary as minimum wage. Workers are afraid of speaking out against their bosses!” an angry Bou Habib of the Lebanese Trade Union Training Center told The Public Source.

At the same time, the NSSF’s assets are held up in funds it cannot recoup.

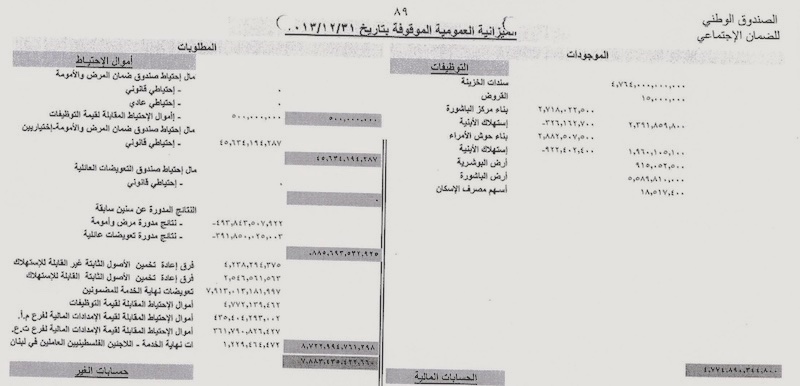

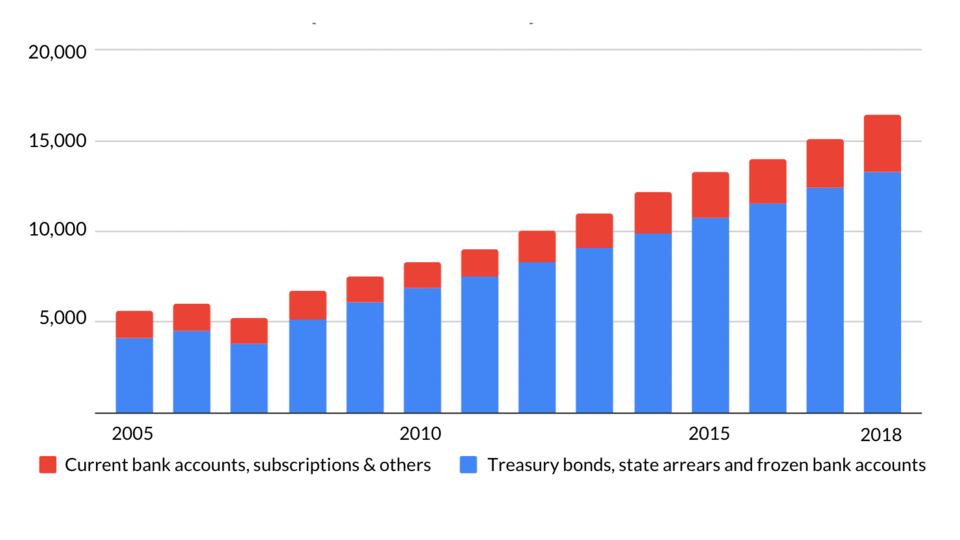

If we look at the NSSF’s assets from 2005 to 2018, we see that as a whole, they grew steadily, from L.L. 5.598 trillion to L.L. 16.460 trillion.

But if we disaggregate the assets by type, panic sets in.

By law, the NSSF is allowed to make four types of investments: Lebanese Treasury bonds; immovable properties (such as real estate assets); loans to public entities and public corporations that have a guarantee from the state; and housing loans to NSSF subscribers and civil servants (excluding security personnel).

Since 2005, the majority of the NSSF’s assets have been either Treasury Bonds, unpaid arrears from the Lebanese state, or funds deposited in frozen bank accounts. By 2018, this combined class of assets constituted 81 percent of total assets.

Figure 3: Growth of the NSSF’s assets from 2005 to 2018, in billions of Lebanese Liras, disaggregated by type of asset. Source: NSSF Budgets 2005-2018.

Now that the Lebanese state has officially declared its bankruptcy by defaulting on its debt in March 2020, and now that the “nationally regulated Ponzi scheme” that Lebanese commercial banks had been engaged in since the 1990s has been unraveled, the NSSF is in an impossible situation.

The NSSF’s funds in frozen bank accounts are inaccessible, while the arrears the Lebanese state owes it or any returns on Treasury Bonds are not going to be seen any time soon. In other words, a little over four-fifths of the NSSF’s assets are quasi-obsolete.

The NSSF’s funds in frozen bank accounts are inaccessible, while the arrears the Lebanese state owes it or any returns on Treasury Bonds are not going to be seen any time soon. In other words, a little over four-fifths of the NSSF’s assets are quasi-obsolete.

“If the right policies and decisions are not taken, and if there is no executive branch willing to implement these policies in full transparency, the NSSF will collapse. If the Health and Maternity Insurance branch suddenly has to pay all of its debts, the NSSF will collapse,” warned Choucair.

Who Is Responsible?

Who made the financial decisions that led to Abu Atef and countless others waiting for reimbursements that may never come?

Within the NSSF, there is a specific committee tasked with advising the board of directors on how to invest its assets. This Finance Committee is supposed to serve four-year terms, its seven members appointed by decree by the Council of Ministers, following recommendations from the labor and finance ministers.

The NSSF has been without a Finance Committee since January 2013, when the term of the last committee expired.

The Public Source spoke with Alain Bifani, who headed the last committee between 2000 and 2013, in his capacity as director general of the Ministry of Finance — a position that always doubles as head of the NSSF Finance Committee.

“The Finance Committee is an advisory committee. It has no executive powers. It cannot impose anything on the NSSF’s Board of Directors. It can only provide advice on how the NSSF’s funds are to be invested,” Bifani emphasized.

We asked why most of the NSSF’s assets are held up in Treasury bonds or frozen in bank accounts. Why hasn’t the NSSF purchased more real estate for itself, for example, especially given that it spends over L.L. 1.6 billion annually in rent of 20 real estate properties across the country?

“The Board of Directors had set aside the idea of investing in housing projects as they were wary of the potential for corruption. So, for decades, they only accepted investing in Treasury bonds,” answered Bifani.

In 2002, coinciding with the Paris II conference, the Finance Committee presented seven propositions to the NSSF Board of Directors to diversify the fund’s investment portfolio, including investing in Eurobonds which, according to Bifani, “would have protected the purchasing power of NSSF subscribers.” But the board, he added, “rejected all our suggestions, except the idea of putting the funds in Lira bank accounts.”

Eventually, the board of the NSSF “got bored of our suggestions and recommendations, and they stopped appointing the Finance Committee,” said Bifani.

Subscribers wait for their turn at the third floor of the NSSF's Cola branch. Beirut, Lebanon. October 8, 2021. (Marwan Tahtah/The Public Source)

Shortly after the committee’s term expired, Bifani says he reached out to the labor minister who seemed to show enthusiasm about forming a new committee.

“Around five ministers later, no committee has been formed,” concluded Bifani.

“Every year we urge the Council of Ministers to form this committee, but they don’t heed our words,” said NSSF CFO Chawki Abou Nassif.

This brings us to the NSSF Board of Directors, a tripartite 26-member board that is ostensibly meant to represent the state, employers, and labor. Six members are appointed by the government, 10 by employers’ associations, including the Association of Banks in Lebanon, and 10 by the General Confederation of Workers in Lebanon (GCWL).

“The Board of Directors has been inoperative for several years now. The government’s representatives aren’t working, and the NSSF is running without a board,” according to Ziad Abdel Samad, the executive director of the Arab NGO Network for Development and an expert on social protections.

Even when the board was operative, it left much to be desired.

According to a recent report by the International Labour Organization, the board’s “decision-power is hindered by vested interests, lack of commitment” and “decisional inertia, which is highly detrimental to the reforms process.”

Decisional inertia has not been helped by the large size of the board, especially because decisions require an absolute majority among all three representative sides on the board.

In the original NSSF law, the board was composed of only 11 members, but the number was expanded to the current 26 in 1982. “What is this, a parliament?! Is the NSSF Board of Directors a parliament?!” asks Jamil Malak, a civil servant who worked in the NSSF from 1970 until his retirement in June 2003.

Adding to the decision-making paralysis, key executive actions that the board is legally allowed to undertake (such as authorizing the director general to purchase or sell immovable assets, approving the NSSF’s annual budgets or undertaking any administrative changes) can only be done via a governmental decree or with the approval of the labor ministry, the NSSF’s guardianship authority. This extra step has often been complicated.

Given the convoluted and disjointed decision-making process, the director general — officially responsible for the day-to-day executive management of the NSSF — has come to play an all-powerful role within the institution.

Since 2002, this post has been held by Mohamad Karaki, who is known to be close to Nabih Berri, the speaker of parliament. A golden plaque from Berri’s Amal Movement congratulating Karaki graces his desk, as captured in official NSSF photos.

“The director general is the one who is really in charge,” said Akram Najjar, an IT expert and consultant, who was appointed to the board as a government representative in June 2006. Unlike most board members, Najjar was not a political appointee — his name was proposed by a colleague of his at a time when the government was looking to quickly replace members who had resigned.

“The board is simply ruled by the director general, and the board members have no say in anything. They don’t do any strategic planning. They don’t decide on anything. Projects come from the NSSF administration, and the board just signs the papers.” — Akram Najjar, consultant appointed to the board as a government representative

“The board is simply ruled by the director general, and the board members have no say in anything. They don’t do any strategic planning. They don’t decide on anything. Projects come from the NSSF administration, and the board just signs the papers,” added Najjar.

Three of Akram Najjar’s colleagues stopped showing up to the NSSF board meetings.

Eventually, after becoming disillusioned with the whole process, Najjar submitted his resignation, which was finally accepted in April 2019.

The Public Source repeatedly tried to reach Director General Karaki, but our requests were ignored.

A worker browses through a filing cabinet on a balcony of the NSSF branch in Cola. Like most Lebanese state institutions, the NSSF remains heavily paper-based. Beirut, Lebanon. October 8, 2021. (Marwan Tahtah/The Public Source)

The Oligarchy Takes Over the NSSF

“[The ruling class] wants to dominate the NSSF, be it by not paying the arrears, or by cheating in the accounts, or by investing all of the NSSF’s funds into Treasury Bonds — all of this is one way through which the political class can put its hands on people’s money to cover the state deficit. It is as simple as that!”

Charbel Nahas, former labor minister and current secretary-general of anti-establishment party Mouwatinoun wa Mouwatinat fi Dawla (MMFD), argues that there has long been an attempt by the ruling class to fully take over the NSSF.

According to Nahas, what the state owes the NSSF should be considered part of the public debt — yet, Lebanon’s politicians deliberately omit the arrears to the NSSF in the state’s accounts in order to exclude them from the public debt. “That way, the public debt can appear lower than what it actually is. It is hidden debt!”

Nahas has a point. In the sections dealing with the public debt in state budgets, the gargantuan amounts the state owes the NSSF are nowhere to be seen.

“[The ruling class] wants to dominate the NSSF, be it by not paying the arrears, or by cheating in the accounts, or by investing all of the NSSF’s funds into Treasury Bonds — all of this is one way through which the political class can put its hands on people’s money to cover the state deficit. It is as simple as that!”— Charbel Nahas, former labor minister and current secretary-general of anti-establishment party Mouwatinoun wa Mouwatinat fi Dawla

The 2022 draft budget law pays lip service to the government repaying its debts to the NSSF, but in February 2022, it was revealed that discussions were taking place at the highest echelons of power to write off the state’s debt to the NSSF. By then, debt had reached L.L. 5 trillion, according to NSSF Director General Karaki.

Since 2010, no external audit has been carried out on the NSSF’s finances. The audit reports of the years 2006 to 2010, prepared by an external auditing firm, reportedly raised significant question marks regarding potential fraud and increasing deficits in the HMI branch.

Any audits of NSSF finances would have had to come from within — the NSSF falls outside the purview of two of the Lebanese state’s main oversight bodies (the Civil Service Board and the Central Inspection Board), while the Court of Accounts, despite being legally allowed to audit its finances, has been notoriously understaffed and underfunded.

The NSSF’s Technical Committee is a three-member body responsible for preparing annual audit reports on the NSSF’s accounts and expenses. Between 2003 and 2021, it was headed by Samir Aoun, the protagonist of one the most notorious cases of grand corruption in the NSSF.

When he was appointed, Aoun, a lawyer by training, was an adviser to then-Minister of Labor Assaad Hardane, who headed the Syrian Social National Party (SSNP).

In late 2016, 13 years after his appointment, Aoun and six other NSSF employees were charged with fraud and embezzlement of L.L. 6 billion (around $4 million at the time). Political pressure on the judicial investigation, reportedly from the SSNP, coupled with Lebanon’s notoriously co-opted judiciary, let Aoun off the hook. Aoun retired at the end of 2021 and the Technical Committee has not met since.

“Basically, the NSSF is very corrupt at all levels,” said a visibly frustrated Najjar. “Corruption comes in many forms and shapes in the NSSF” — be it sophisticated crimes such as forging or inflating medical receipts and bills to benefit specific hospitals or doctors, or simply classic embezzlement committed by employees in all ranks of the hierarchy. In March 2014 for instance, several NSSF employees were accused of embezzling over L.L. 1 billion of the NSSF’s funds through forged medical bills and receipts. A little over a year later, three NSSF employees of the Dora branch were charged with “embezzlement of funds, forgery and fraud.”

Jamil Malak, with his long experience in the NSSF, echoed these claims. Referring to the NSSF in the post-civil war era, he reflected, “At one point, no matter what issue you wanted to look at in the NSSF, you would be putting your hands on a corruption scandal! Nothing was being done without any political backing!”

In addition to political cover for corruption, oligarchic control over the NSSF also works in more subtle ways. For two decades, plans to digitize the NSSF have been reportedly resisted or undermined by Karaki, while large sums have been spent on studies of how digitization would occur.

After all, “without computerization, you cannot do proper oversight and corruption can fester,” says Ghassan Slaiby, a veteran labor activist and researcher.

A caved-in room in Hamra, decorated with graffiti -- its walls read: (left) "Universal humanity"; (right) "Nourishment, healthcare, housing." The collapsed wall gives way to a thick blanket on the ground, seemingly left behind. Beirut, Lebanon. March 15, 2022. (Marwan Tahtah/The Public Source)

Who Will Fight for the NSSF?

“When the NSSF was first established, Reda Wahid used to say ‘I want NSSF employees to be even faster than the banks! When a subscriber comes to the NSSF with his medical bills and receipts, I want him to stand in line, I want the employees to handle his procedures fast, and then pay him what he is owed. I don’t want him to wait for 30 minutes!’”

Jamil Malak has fond memories of the days when Wahid was director general of the NSSF, from 1965 to 1983. Wahid, a physician by training, occupied several senior positions in the Lebanese state, serving briefly as minister of social affairs in 1964 and minister of public health in 1966. But he is remembered for his tenure as the NSSF’s first director general, a job that by all accounts he diligently carried out with the dedication expected of committed civil servants who seek to serve the public — so much that he was affectionately nicknamed “Abu Daman.”

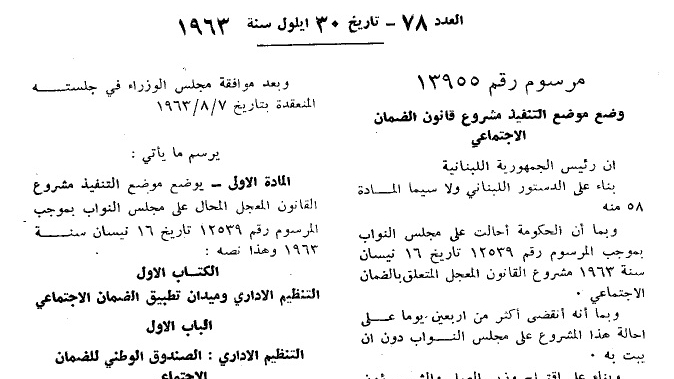

Decree 13955, the 'NSSF law,' published in the National Gazette on September 30, 1963.

But from the beginning the NSSF had many enemies.

“Most MPs and businessmen and even some unionists working in the big businesses, such as banks, were against the NSSF,” recalled Adib Bou Habib, head of the Lebanese Trade Union Training Center.

Employers and business owners were adamantly against the idea of contributing on a monthly basis to their employees’ social protection — instead, “they argued that they wanted to spend their money how they chose,” added Bou Habib.

“If there was no Fouad Chehab, the NSSF law would have never been passed,” affirmed Malak. “He was very concerned and a strong believer in the NSSF. He knew that the capitalist system in Lebanon and the people in power in parliament were against the NSSF. This is why he passed the NSSF law via a decree.”

Indeed, the NSSF was one of the crowning reforms of the presidency of Fouad Chehab (1958-1964), and Chehab made use of the wide powers available to the president in the pre-Taef era to establish the NSSF despite the parliament’s objections.

Yet it is important to remember that labor had not been sitting idly by. With around 22 percent of workers unionized by the mid-1960s, the labor movement mobilized to demand wage increases, social protections and amendments to Lebanon’s notoriously problematic labor law. Some of the largest and most violently repressed strikes in Lebanon’s history took place in the period when the NSSF was established.

Today, it is unclear who will fight for the NSSF.

For one, Lebanon’s oligarchy seems happy to see it die.

“Representatives of the workers [on the NSSF board of directors] usually come from the officially recognized trade unions — and for the past 15 to 20 years, the representatives have been very close to the political establishment, while all NSSF decisions have been biased towards the private sector.” — Ziad Abdel Samad, executive director of the Arab NGO Network for Development

In mid-2019, “[MMFD] contacted the NSSF — we know them very well — we told them ‘we are heading towards a collapse, you have the funds of a million wage earners, you can’t play with people’s money as if it is a casino,’” Charbel Nahas told The Public Source.

Nahas recounts that MMFD proposed several solutions and recommendations to the NSSF at the time that could have shielded its funds from the coming collapse, but their proposals were ignored. “There was no strong political will to tackle this problem and solve it, and look at where we are now.”

Meanwhile, labor today is either co-opted or divided.

“Representatives of the workers [on the NSSF board of directors] usually come from the officially recognized trade unions — and for the past 15 to 20 years, the representatives have been very close to the political establishment, while all NSSF decisions have been biased towards the private sector,” Abdel Samad told The Public Source.

Nahas was more blunt. “[The representatives of labor] are thugs who come from the General Confederation of Workers (GCWL) in Lebanon, they’re really the worst. [The representatives of employers] aren’t saints, but even they are better than the workers’ representatives in NSSF.”

Highly fragmented and hierarchical, the system creates classes of workers, with some workers receiving better packages than their peers in other professions. By creating a hierarchy of privilege among workers, the system itself encourages discord within the working class, dilutes solidarity across professions, and undermines class solidarity.

Widely regarded as an ally of the working class, during his tenure as labor minister (June 2011—February 2012), Nahas had his share of clashes with the GCWL, including when they refused to support his proposal for establishing universal health care funded by taxes on real estate profit, interest income, and other-rent based activities — the most significant and inclusive welfare proposal since the 60s.

Busy day at NSSF's Cola branch. Beirut, Lebanon. October 8, 2021. (Marwan Tahtah/The Public Source)

The absence of support for universal health coverage among Lebanon’s organized labor reveals the core problem that afflicts Lebanon’s system of social protections. Highly fragmented and hierarchical, the system creates classes of workers, with some workers receiving better packages than their peers in other professions. By creating a hierarchy of privilege among workers, the system itself encourages discord within the working class, dilutes solidarity across professions, and undermines class solidarity.

Civil servants and members of the state security apparatus are entitled to generous social protections outside the scope of the NSSF. While they have mobilized on a mass scale for salary adjustments, civil servants have repeatedly ignored calls for them to compromise on their salary adjustment in return for instating universal health care. Workers in the various liberal professions, such as engineers and lawyers, have their own pensions and health schemes tied to their syndicates. Sectarian parties offer welfare services and social protections in exchange for votes and quiescence. A myriad of local and international NGOs, charities and faith-based institutions disjointedly provide social protections and welfare. And Lebanon has a high reliance on private insurance companies for health coverage.

The story of the NSSF in the post-civil war era is the story of entrenched oligarchic interests, high-level corruption, and ultimately, insolvency.

Amid this fragmented landscape, by excluding informal labor, the NSSF created yet another “division within the workers and the working population.”

The story of the NSSF in the post-civil war era is the story of entrenched oligarchic interests, high-level corruption, and ultimately, insolvency. Many individuals tried to make changes from within only to resign in protest or disillusion. Many experts on the outside have proposed reforms, from the technocratic to the structural, only to be ignored.

Ultimately, this is also the story of co-opted and divided labor.

Ultimately, this is also the story of co-opted and divided labor. The NSSF’s tragic tale should serve as a cautionary reminder that even institutions established by reformist currents with ostensibly good intentions are ripe for capture and decimation by the oligarchy, if they do not have organized constituents willing to fight for them.