Public Debt: It’s Not the Size That Matters, It’s How You Use It (Part 1 of 3)

Day 29: Thursday, November 14, 2019

Lebanon’s public debt has been at the forefront of discussions since the start of the popular uprising on October 17. We have all become acquainted with the figure of “150 percent:” Lebanon’s famous current debt-to-GDP ratio.

We have also heard two main solutions to the “debt problem.” On the one hand, many leftists are calling for the nationalization of banks. Given that the debt is owned by Lebanese private banks, the logic goes, nationalizing them would cancel the debt. We have seen no further analysis or specific plans related to this call, although some proponents admit that the call is mainly intended to initiate a discussion — one that has yet to arrive. On the other hand, a group of economists, political scientists, and jurists have called for debt reduction, as presented in the November 10 statement “For an Emergency Economic Rescue Plan for Lebanon.” They too did not elaborate a specific plan, but presented three broad principles: the reduction should be deep, the losses incurred must be distributed fairly, and a strong banking sector is to be maintained. And while the statement does not specify the degree of reduction, it does mention that “the internationally recognized safe limit is considered to be at 50% GDP.”

It is fair to say that neither proposal offers more than a vague vision for dealing with debt — the former entrenched within a Bolshevik tradition, the latter within neoliberalism. What we are missing is a comprehensive approach to Lebanon’s debt that is grounded in a broader discussion of public debt beyond our borders, and which questions conventional concepts and terms.

Let’s begin with the debt-to-GDP ratio, the famous 150 percent figure. Like many indicators in economics, this one can obscure and confuse more than it explains. For instance, if we look at this figure over time, we see that debt-to-GDP soared in Lebanon in the 1990s to reach 183 percent in 2006, then fell to 131 percent in 2012, and finally rose to 151 percent in 2018. Does this trajectory mean that the current debt situation is better than that in 2006? Does it suggest that in 2012 Lebanon was heading in the right direction of debt reduction? Moreover, if we look at debt-to-GDP cross-nationally, we find that Lebanon is surpassed only by Japan (currently at 238 percent) and Greece (currently at 183 percent) in the wake of the 2008 economic crisis. Does this indicate that Lebanon’s debt situation is healthier than these two countries?

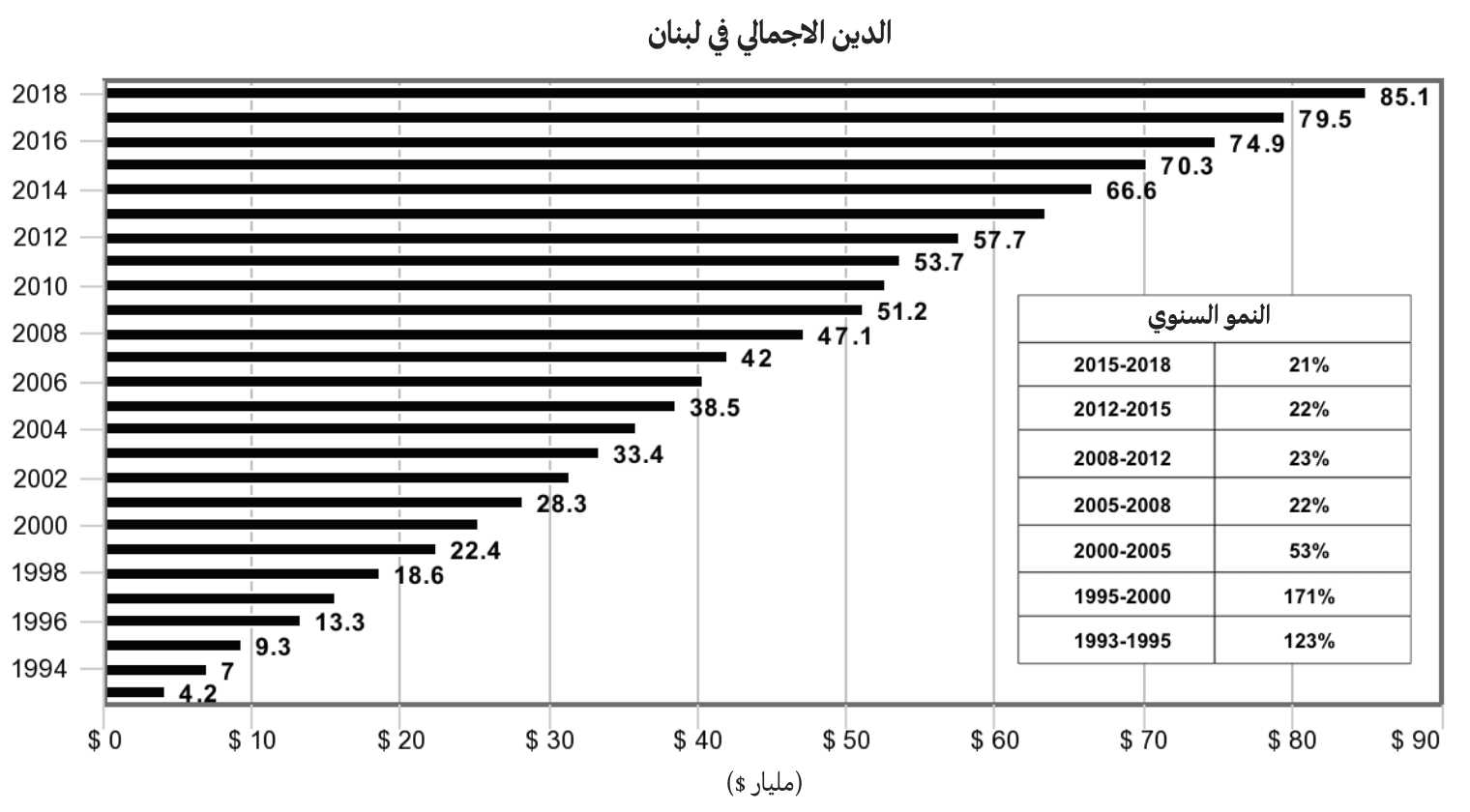

The answer to all these questions is a categorical “no.” In short, thinking of debt in relation to GDP is confounding. For one, as the graph below shows, debt was constantly increasing in Lebanon through the years despite the ebbs and flows in debt-to-GDP figures.

In addition, GDP is a misleading indicator that can be easily manipulated. In 2014, the Spanish government in its attempt to depict an economic recovery included in its GDP illicit activities from drugs to prostitution. If such activities, not to mention money laundering, were included in Lebanon’s GDP, who knows, debt-to-GDP might reach the magical target of 50 percent.

But most importantly, we tend to forget that it is not the gross domestic product that repays the debt, but the state. And naturally, state revenue need not be correlated with GDP. Revenue is the result of the type and level of taxation. A growth in GDP not accompanied by a taxation policy targeting the profits emanating from this growth has little to no impact on government revenue, and consequently on public debt. In sum, the debt-to-GDP ratio says little more than, “the debt is pretty large.”

Moreover, this emphasis on the size of debt creates a false notion that debt is in itself inherently problematic for an economy. Yet the economic revolution that was capitalism came into being with debt at the start of a cycle's chain of causality. To simplify: first came borrowing, then investment, and finally profit and accumulation. And in the past four decades, government debt has ballooned around the world, driven mainly by the advent of neoliberalism and the low taxation policies for corporations and the very wealthy, the mantra of trickle-down economics. This has left states with little revenue to finance their welfare systems, not to mention the exorbitant projects that ultimately benefit the few, the very wealthy, and large corporations. Lebanon’s debt was accumulated as a result of such policies, primarily in the 1990s, although it is worth noting that Lebanon’s welfare system is nearly non-existent.

Rather than seeing debt as an inherent problem in itself, the questions we should be asking are the following: how does a country service its debt? And what is the borrowing used for? These issues will be developed further in the subsequent two parts of this series. But for now: on the first point, it is crucial to note that in 2016, Lebanon’s interest payments as a percentage of government revenue stood at 50.84 percent, the highest in the world. This bears repeating: more than half of the Lebanese state’s revenue was spent on servicing the debt. On the second point, on November 27, Lebanon issued $3 billion bond to repay around $1.5 billion bond that matured during that month. In brief, for decades the policy has been to borrow more in order to repay the debt, and to mobilize a large part of the state revenue towards this end.